- GAAP COST PRINCIPLE HOW TO

- GAAP COST PRINCIPLE CODE

- GAAP COST PRINCIPLE PROFESSIONAL

- GAAP COST PRINCIPLE DOWNLOAD

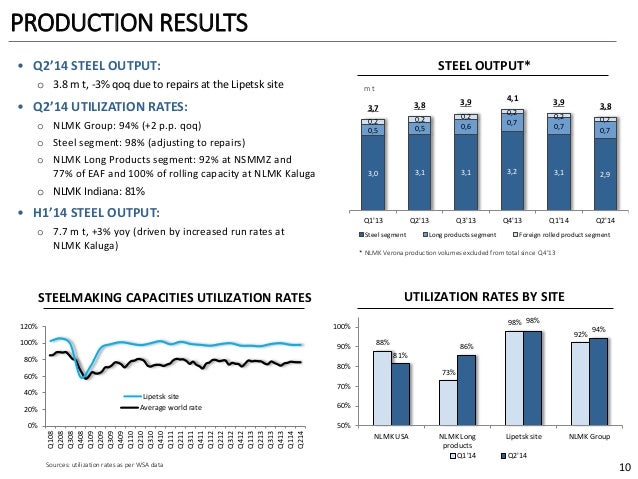

Suppose it was temporarily out-of-stock for the quarter.

GAAP COST PRINCIPLE CODE

As the cash flow statement has information about cash receipts, cash payments, etc., this code lists method activities such as direct and indirect for guided reporting.Įxample of Microsoft’s 2021 Income Statement (Source: Microsoft Annual Report):.This ASC standard issues an apparent allotment of cash flow to operating, financing, and investing divisions.Additionally, it lays out the easy distribution of a firm’s finances along with understanding their income and expenses flow.This code gives several rules for the effective presentation of the income and shareholder’s equity statement.ASC 215 and 225 – Shareholder Equity and Income Statement The guidelines cover the methodological classification of assets and liabilities, the balance sheet offset, and more.ģ.It is a technique of specifically presenting the balance sheet among the financial statements.It guides companies through reporting discontinued operations, accounting on a liquidation basis, going concern, and even comparative statements.It provides understanding and establishes the framework for overall financial statement presentation.ASC 205 – Presentations of Financial Statements It also allows people outside the firm to analyze the reports without complexity.įASB (Financial Accounting Standards Board) sets the standard accounting codifications to provide uniformity to a company’s financial reports.

Financial reporting procedures should be consistent, allowing for comparison of the company’s financial information.They should not cover any debts or assets under income to maintain transparency.Companies should comply with this principle by openly reporting both negative and positive aspects of their business.All finances recorded and reported should be honest and correct.

GAAP COST PRINCIPLE PROFESSIONAL

While creating finance documents, accountants should assume that the firm will be in business for eternity.Every accountant responsible for building finance reports should follow specific rules and portray the data accurately.This principle governs the sincere representation of the gathered information.Accountants should disregard any information derived from assumptions.All records, statements, reports, etc., should be verifiable and based on validated statistics.It guides them about the type of transactions to record and report promptly.It states that accountants must follow the US-GAAP while preparing financial statements that investors, creditors, and other stakeholders use to evaluate a company’s performance.In contrast, US GAAP can be a little complex. IFRS principles are all-inclusive and international companies can easily use them.Some prominent principles are consistency, continuity, regularity, periodicity, and others.

GAAP COST PRINCIPLE HOW TO

GAAP COST PRINCIPLE DOWNLOAD

Download Corporate Valuation, Investment Banking, Accounting, CFA Calculator & others Key Highlights

0 kommentar(er)

0 kommentar(er)